1 Stock to Buy, 1 Stock to Sell This Week: McDonald’s, PayPal

- ISM Services PMI, Fed Speakers, and more earnings will be in focus this week.

- McDonald’s (NYSE:) is a buy with strong earnings due on Monday morning.

- PayPal (NASDAQ:) is a sell amid weak sales growth, prudent guidance on deck.

- Looking for more actionable trade ideas to navigate the current market volatility? Members of InvestingPro get exclusive ideas and guidance to navigate any climate. Learn More »

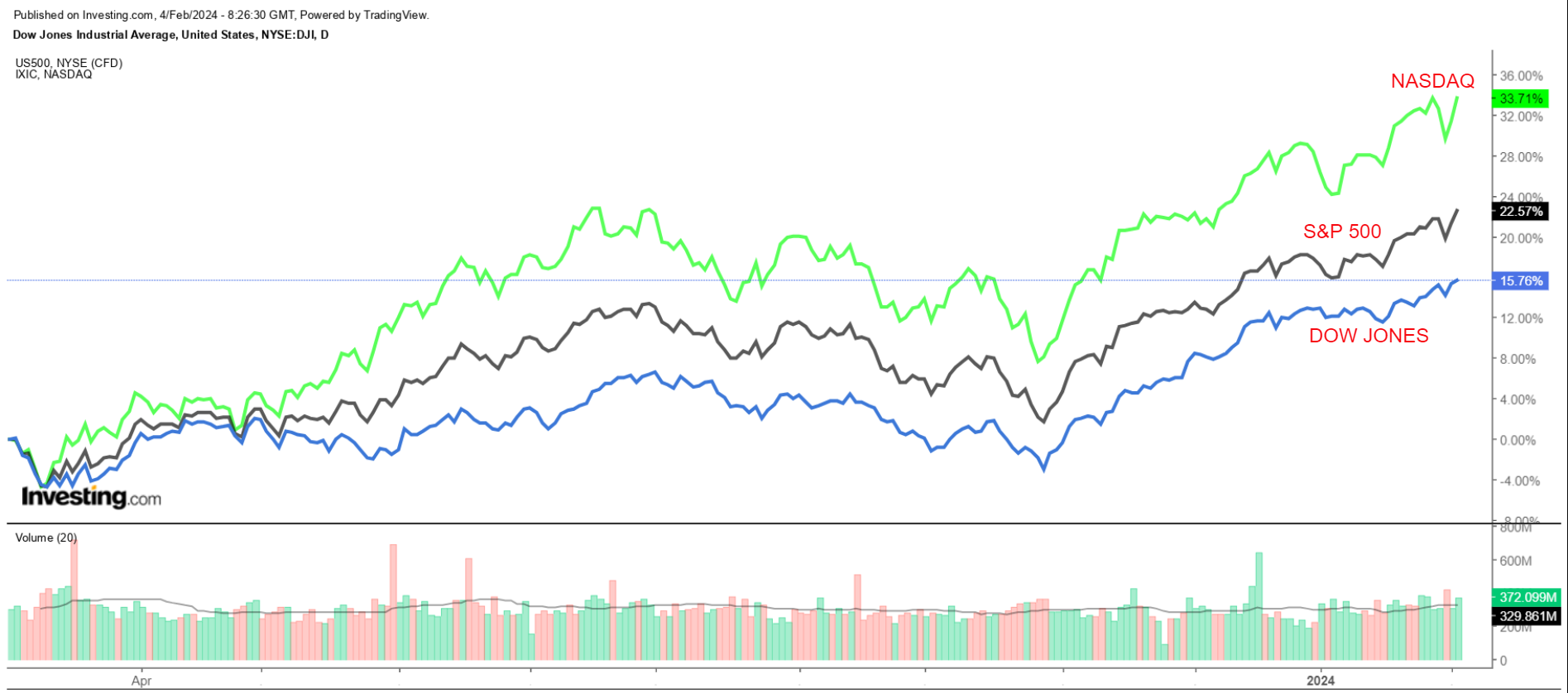

Stocks on Wall Street closed higher on Friday, with the reaching a fresh record peak, as investors cheered robust quarterly results from Meta Platforms (NASDAQ:) and Amazon (NASDAQ:) as well as a blowout jobs report which boosted confidence in the economy.

For the week, the blue-chip , and the benchmark S&P 500 both added 1.4%, while the tech-heavy tacked on 1.1% to mark their fourth straight week of gains.

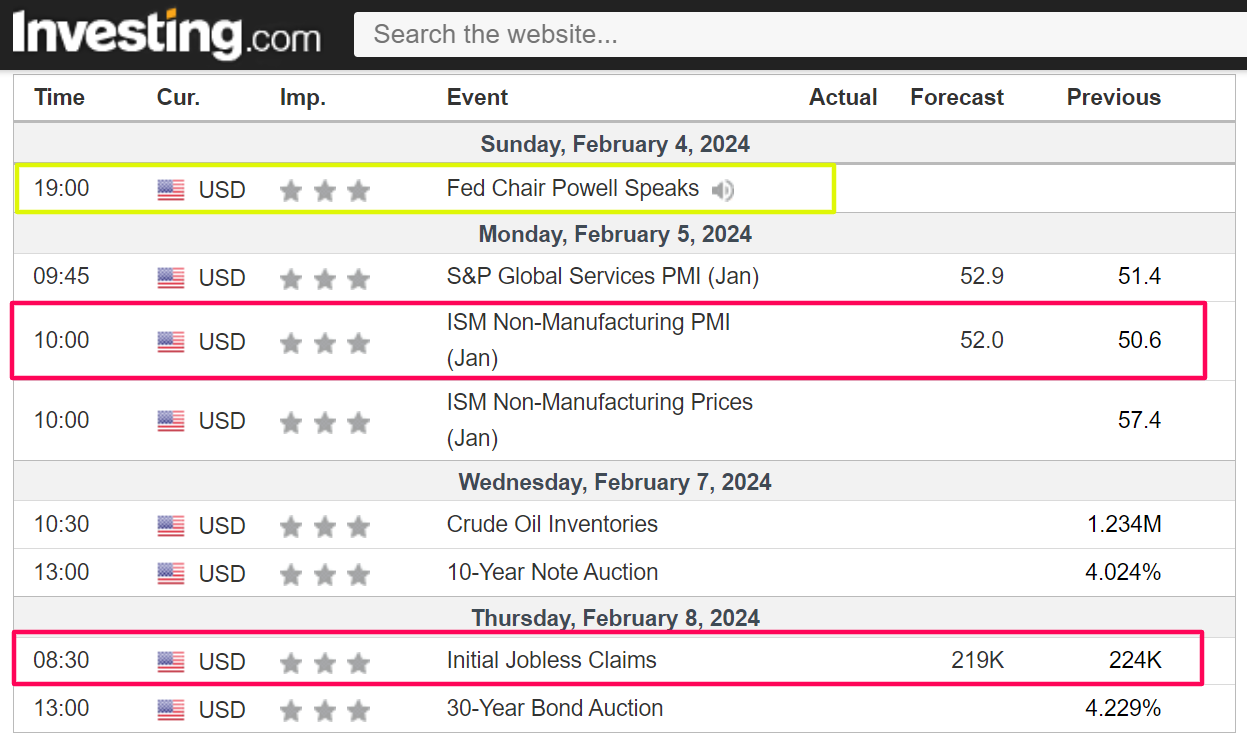

The week ahead is expected to be another eventful one as markets continue to weigh the Fed’s rate plans for the months ahead.

Most important on the economic calendar will be the latest ISM non-manufacturing PMI survey as well as the latest jobless claims figures.

Those releases will be accompanied by a heavy slate of Fed speakers, with the likes of district governors Loretta Mester, Thomas Barkin, and Raphael Bostic set to make public appearances following last week’s FOMC meeting.

Meanwhile, Fed Chair Powell will discuss the economy and inflation risks on CBS News’s ’60 Minutes’ on Sunday night.

As of Sunday morning, financial markets see an 80% chance of the Fed leaving rates unchanged in March, according to the Investing.com . Looking out to May, investors believe there is a roughly 73% chance rates are lower by the end of that meeting, down from over 95% just a few weeks ago.

Elsewhere, the earnings season continues, with the list of heavyweights due to report including Walt Disney (NYSE:), Caterpillar (NYSE:), McDonald’s, Pepsico (NASDAQ:), Eli Lilly (NYSE:), Ford (NYSE:), and PayPal.

Some of the other notable reporters include Palantir (NYSE:), Snap (NYSE:), Pinterest (NYSE:), Uber (NYSE:), ELF Beauty (NYSE:), Arm Holdings (NASDAQ:), and Alibaba (NYSE:).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, February 5 – Friday, February 9.

Stock To Buy: McDonald’s

I expect McDonald’s stock to outperform in the week ahead, with a potential breakout to a new record high on the horizon, as the fast-food chain’s latest earnings report will surprise to the upside in my opinion thanks to favorable consumer demand trends.

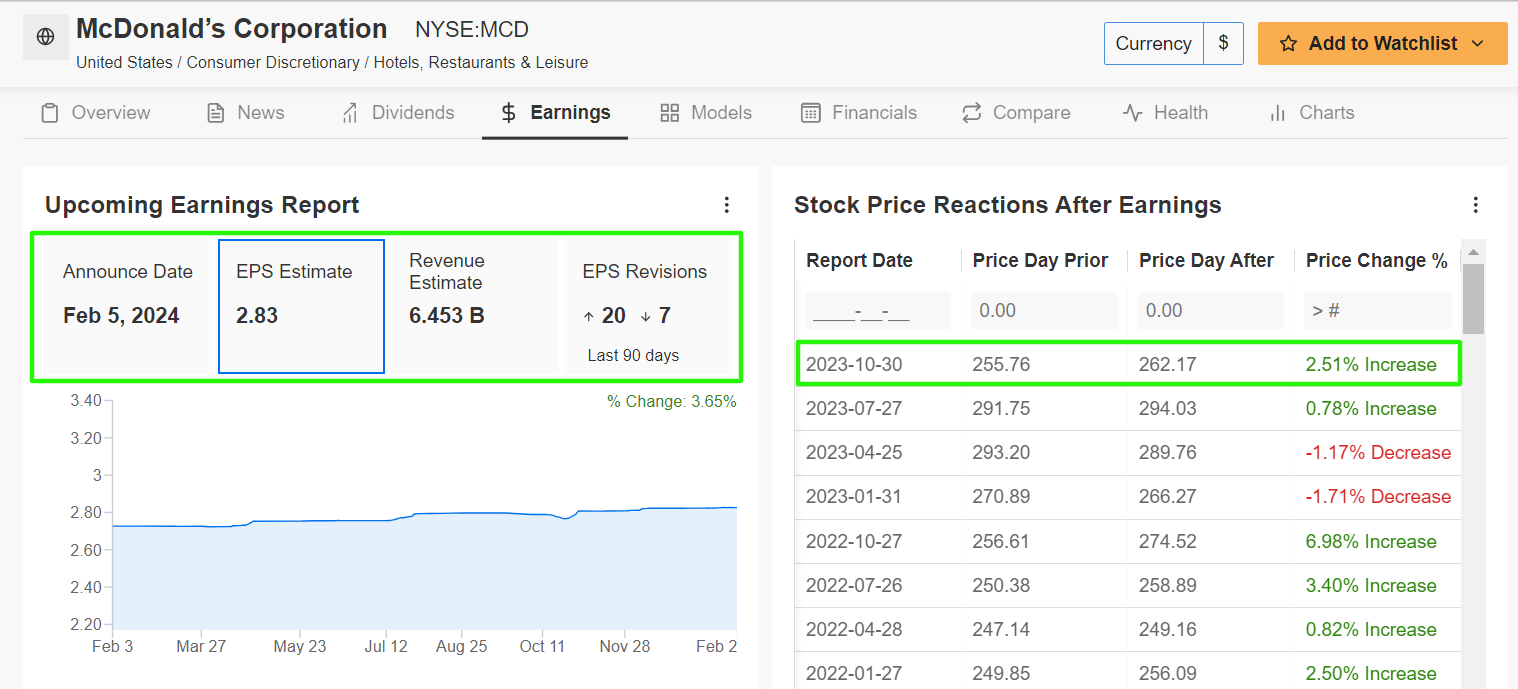

McDonald’s is scheduled to deliver its update for the fourth quarter before the U.S. market open on Monday at 7:00AM ET.

Market participants expect a possible implied move of around 3% in either direction in MCD shares after the numbers drop. The stock gained 2.5% after its last earnings report in late October.

It is worth mentioning that an InvestingPro survey of analyst earnings revisions points to growing optimism ahead of the print. Of the 27 analysts surveyed, 20 upwardly revised their MCD profit forecast in the last 90 days.

Consensus expectations call for McDonald’s to post Q4 earnings per share of $2.83, rising 9.3% from EPS of $2.59 in the year-ago period. Meanwhile, revenue is forecast to jump 8.8% year-over-year to $6.45 billion as the fast-food giant benefits from higher menu prices, unique marketing promotions, and a successful digital loyalty program.

U.S. same-store sales – which surged 8.1% in Q3 – will likely top estimates again as consumers flock to its stores amid the current economic environment.

Many Americans have cut back spending at traditional full-service restaurants in response to a slowing economy and persistently high inflation, boosting demand for McDonald’s iconic lineup of ‘Big Mac’ burgers and chicken ‘McNuggets’.

Looking ahead, I believe CEO Chris Kempczinski will provide upbeat profit and sales guidance for the current quarter as the burger chain remains well positioned to thrive amid the uncertain macro environment.

MCD stock ended Friday’s session at $297.05, a tad below its all-time high of $302.39 reached on Jan. 22. Shares – which are one of the 30 components of the Dow Jones Industrial Average – are up 12.4% over the past year.

The Chicago, Illinois-based fast-food company has a market cap of $215.5 billion, making it the world’s biggest quick-service restaurant chain.

As ProTips points out, McDonald’s is in ’Good’ financial health condition, thanks to strong earnings prospects, a robust profitability outlook, and an attractive valuation. Additionally, it should be noted that the company has raised its dividend for 48 consecutive years.

Stock to Sell: PayPal

I believe shares of PayPal will underperform this week, as investors position themselves for a disappointing earnings report from the embattled digital payments provider.

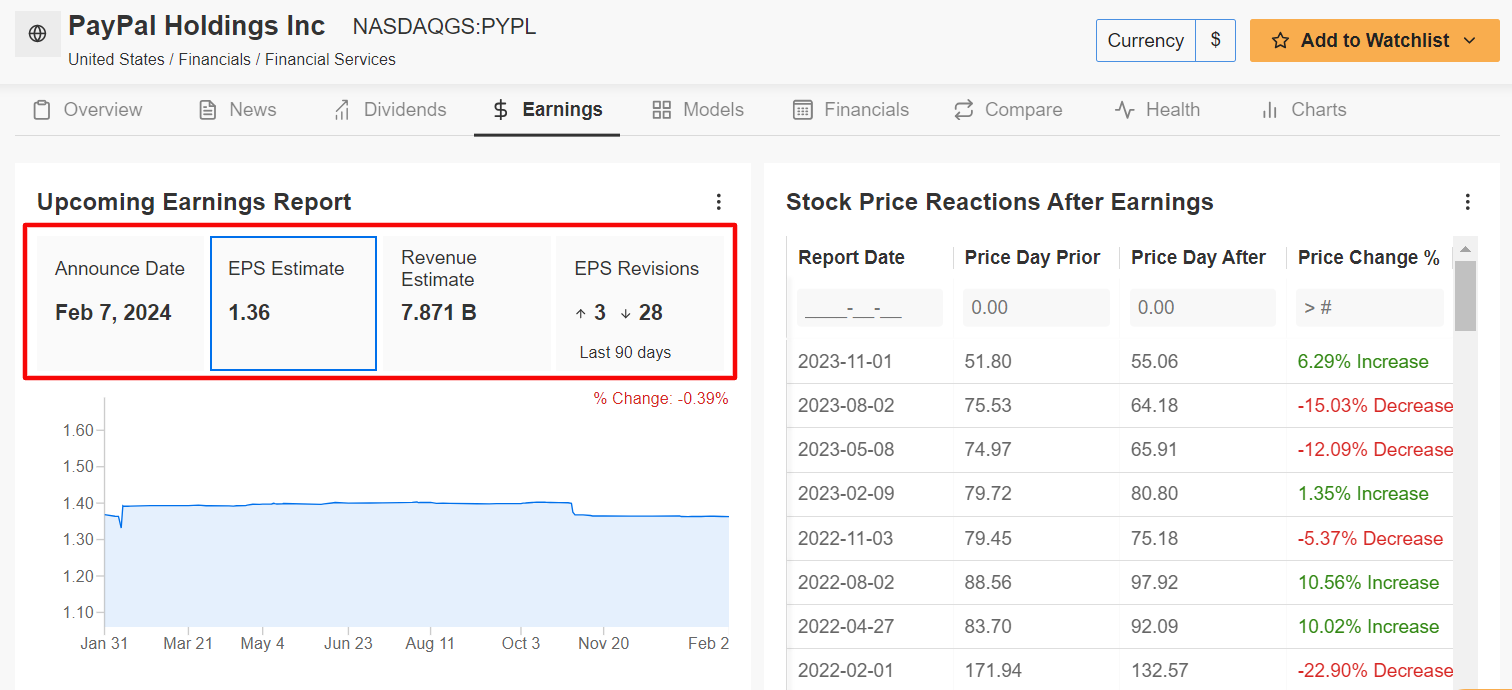

PayPal’s fourth-quarter print is scheduled to come out after the closing bell on Wednesday at 4:15PM ET and results are likely to take a hit from a slowdown in its core e-commerce business as it continues to lose market share in the online payments industry.

Not surprisingly, profit estimates have been revised to the downside 28 times in the past three months, according to an InvestingPro survey, compared to just three upward revisions.

As per the options market, traders are expecting a move of about 8% in either direction for PYPL stock following the release. Notably, shares jumped 6% after the company’s Q3 report in early November.

Wall Street sees the digital payment processing company earning $1.36 a share in the final three months of 2023, rising 9.7% from a profit of $1.24 in the year-ago period, amid the positive impact of reduced operating expenses and ongoing job cuts.

PayPal said last week it planned to lay off 9% of its workforce, or roughly 2,500 employees, a move in line with the San Jose, California-based company’s previous commitment to rein in costs.

Meanwhile, revenue is seen increasing 6.4% from last year to $7.87 billion.

Despite the year-over-year improvement on both the top-and-bottom line numbers, I think PayPal’s new CEO Alex Chriss will be conservative in his guidance for the year ahead due to the challenging operating environment.

The fintech company has faced significant headwinds in the past year due to a combination of unfavorable consumer spending and slowing e-commerce trends as well as rising competition in the mobile payments processing industry from the likes of Apple (NASDAQ:), Google (NASDAQ:), Amazon, and Block (NYSE:).

PYPL stock closed at $62.42 on Friday, earning the San Jose, California-based company a valuation of $67.3 billion. Shares are down 27% in the past 12 months, vastly underperforming the broader market over the same timeframe.

It should be noted that PayPal has a below average InvestingPro ‘Financial Health’ score of 2.55 out of 5.0 for the latest period due to concerns over growth prospects, and free cash flow.

*****************

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it’s crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Join now for up to 50% off on our Pro and Pro+ subscription plans and never miss another bull market by not knowing which stocks to buy!

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

[Nasdaq 100, S&P 500, Dow Jones Industrial Average, Caterpillar Inc

#Stock #Buy #Stock #Sell #Week #McDonalds #PayPal