1 Stock to Buy for Today and 1 for Tomorrow

Rtx Corp (NYSE:) and Lockheed Martin (NYSE:) are both high-quality companies that can deliver shareholder value over the long term and drive their share prices ever higher. However, business trends and analysts’ sentiment indicate that RTX is a Buy for 2025 and Lockheed Martin for tomorrow. RTX’s share price will likely trend higher in 2025 and could gain as much as 25% before it peaks. On the other hand, Lockheed Martin will likely wallow near its early February levels until its market can regain traction later in the year. This is a look at what’s driving these defense stocks.

Lockheed Martin Has Headwinds in 2025

Lockheed Martin had a decent 2024 and FQ4, but results were weak due to softness in two of the four segments. The $18.62 billion in net revenue is also down compared to the prior year, contrary to growth in competitor RTX. The critical detail is losses in classified projects. The company has numerous contracts to produce classified results in several segments, and the losses are mounting.

The worst news from Lockheed is that classified losses are cutting into the profits and guidance and will likely grow. Lockheed Martin execs forecast a decent year in 2025, sufficient to sustain capital returns and balance sheet health. Still, it is weaker than the analysts’ consensus, with the potential for underperformance should losses continue to grow.

RTX, in comparison, grew revenue by 8.5% and outpaced MarketBeat’s reported consensus by a significant margin. Growth in all operating segments, including commercial and government business, drove its strength. Organically, the business is up by 11%, and margin expansion is also logged. Margin expansion resulted in leveraged, double-digit bottom-line gains, up 19% adjusted and nearly 1200 basis points better than forecasted.

Analysts Make a Clear Choice and Raise Price Targets for RTX

The analysts’ response is another reason RTX will move higher in 2025 and LMT shares will wallow. Sentiment for LMT remains firm at Moderate Buy, and the consensus forecasts a 20% upside in early February, but price targets are falling. MarketBeat tracked six revisions from 15 analysts following the Q4 release, and 100% had a lower price target. They still see substantial upside but below consensus, and estimates may continue to fall. That is a headwind for the market.

RTX analysts provide tailwinds. Within days of the release, MarketBeat tracked nine revisions, including 100% higher price targets and an upgrade to buy. The revisions suggest this market will move into the high-end range of analysts’ targets, a 25% upside from critical resistance targets.

Capital returns are yet another reason that RTX’s share price will increase in 2025 and that LMT’s will grow over time. Both companies produce ample cash flow, have a fortress balance sheet, and can aggressively repurchase shares while paying dividends and investing in their businesses. Lockheed is more aggressive, reducing its count by nearly 3.75% year over year in Q4, but RTX is no slouch, reducing its count by 1%.

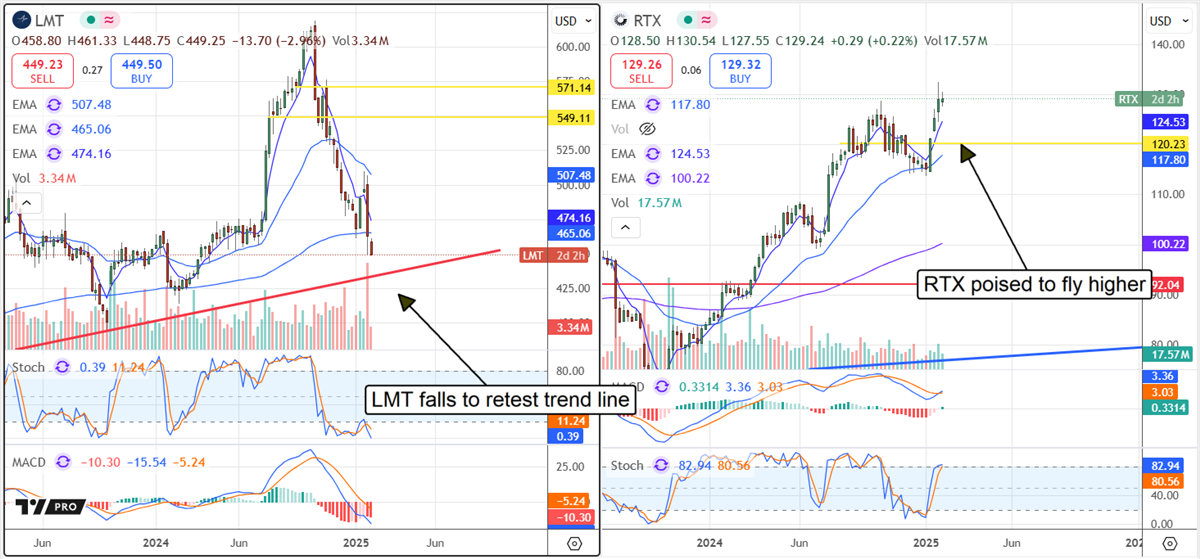

RTX Advances, On Track for New Highs: LMT Returns to Trend

The price action in these stocks reflects their performance and the analysts’ sentiment. Following the release, RTX is moving higher and is on track to extend its rally while LMT pulls back. LMT is returning to a significant trend line, likely nearing its bottom. RTX, meanwhile, could rise by another $15 before midyear. In that scenario, momentum will grow as the year progresses, and it could quickly take this market to the consensus $155. LMT’s share price may wallow near its lows but is not expected to break the trend. The most likely scenario for it is that a bottom forms near current levels, and a rebound begins later in the year.

#Stock #Buy #Today #Tomorrow