Fujifilm to double spending on chip materials as U.S., Japan and South Korea up chip production

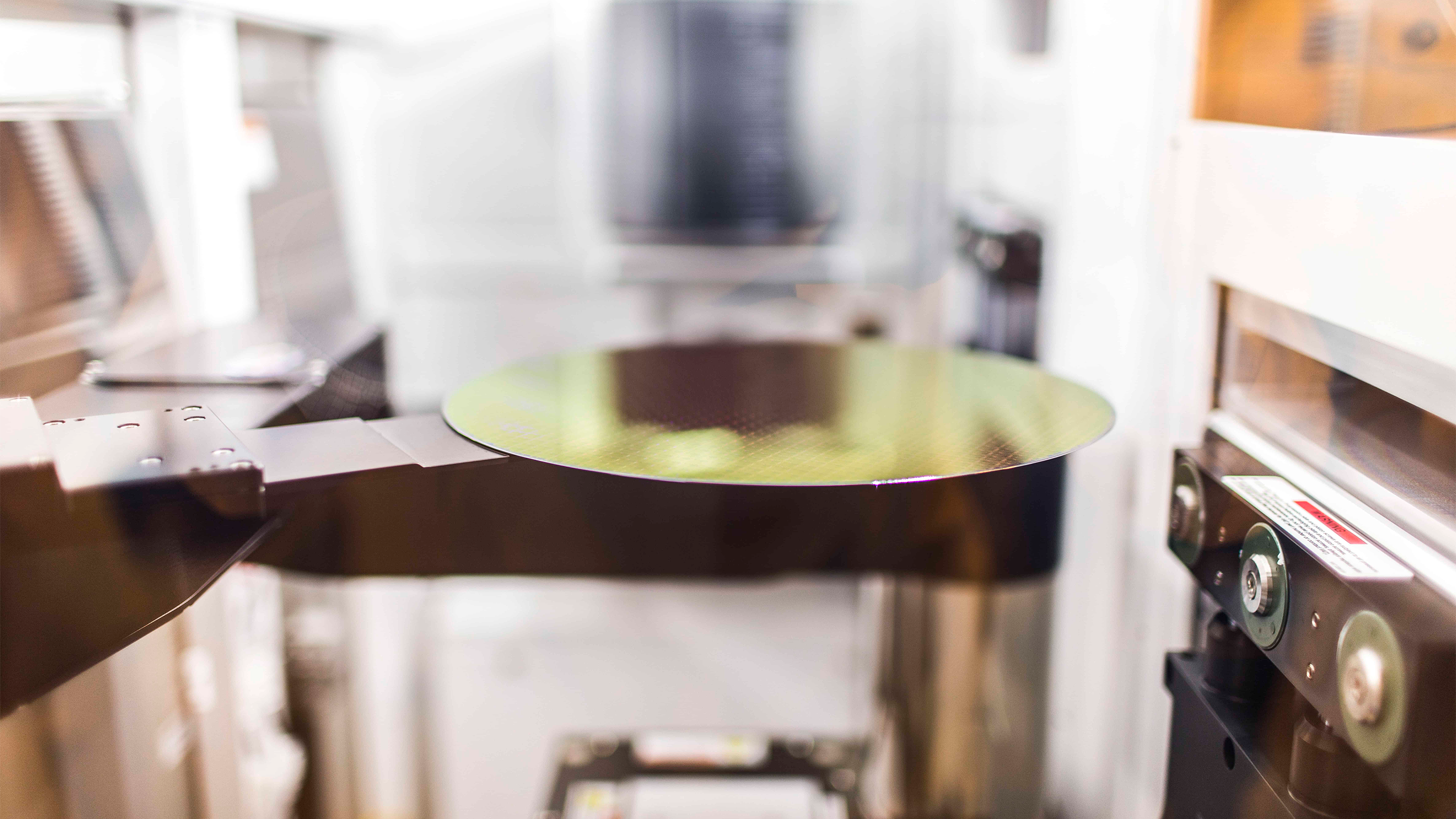

Fujifilm Holdings, a major maker of raw materials for semiconductor production and one of a few suppliers of ultra-pure photoresists for EUV lithography, plans to invest ¥100 billion ($640.5 million) by March 2027 to increase its semiconductor materials production globally, according to Nikkei. The company reportedly aims to expand capacities in the U.S., Japan, and South Korea as major chipmakers are building up new advanced fabs in the said countries. Yet, Fujifilm has yet to confirm the plan.

The outlined spending will double its investment from the last three years, aiming to meet growing demand driven by new fabs in the U.S. (Intel, TSMC), Japan (Kioxia, Micron, TSMC), and South Korea (Samsung, SK hynix) as well as production of ultra-high-end processors for AI and HPC sectors. In addition, the company also plans to tap the Indian market as India is a country that seeks to make microelectronics as well.

Fujifilm ranks fifth globally in photosensitive semiconductor materials and it supplies major chipmakers like TSMC and Samsung. It is also one of five makers of ultra-pure EUV photoresists along with JSR, DuPont, Tokyo Ohka Kogyo (TOK), and Shin-Etsu Chemical. As EUV operates at an extremely short wavelength of 13.5nm, photoresists must meet stringent requirements in terms of sensitivity, resolution, line-edge roughness, and compatibility with EUV photomask materials.

Onshoring of advanced chip production has a drastic effect on the whole semiconductor industry as not only actual chipmakers like Intel and TSMC are establishing new manufacturing facilities, investing tens of billions of dollars, but their ecosystem partners follow, which is the case with Fujifilm.

Fujifilm plans to enhance production near key clients to strengthen partnerships and better serve the rapidly growing semiconductor market. In Japan, Fujifilm is constructing a new facility in Shizuoka for ¥13 billion ($83.27 million). In South Korea, a facility in Pyeongtaek will receive new equipment that is going online by autumn. Additionally, in Cheonan, a plant for producing abrasive agents will boost output capacity by 30% once mass production begins by spring 2027.

The company is also exploring opportunities in India, where it may partner with local firms or establish a joint venture to produce chip materials. Depending on client activity, Fujifilm could build its own facilities there, after fiscal 2027.

Fujifilm identifies chipmaking materials as a key area for growth and plans to double its sales in this sector, targeting ¥500 billion ($3.2 billion) by fiscal 2030, up from the fiscal 2024 level. The expansion aligns with Japan’s dominant position in this critical supply chain as currently the country controls half of the market for essential semiconductor materials.

Research by Fuji Keizai cited by Nikkei predicts the global chipmaking materials market will expand by 35%, reaching $58.3 billion by 2029 compared to 2023 levels.

#Fujifilm #double #spending #chip #materials #U.S #Japan #South #Korea #chip #production