Microsoft Earnings: DeepSeek’s Rise Adds Pressure to Deliver on AI Promises

-

Microsoft’s earnings could reveal if its AI investments can sustain dominance amid rising competition.

-

Azure’s performance and AI costs may drive—or risk—near-term stock momentum.

-

Microsoft faces a pivotal test to prove Big Tech leadership in a fast-changing landscape.

- Kick off the new year with a portfolio built for volatility and undervalued gems – subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro!

Can one of the world’s largest companies – Microsoft (NASDAQ:), with five decades of history and market dominance—truly fear a scrappy startup’s new app?

The fact this question even arises says everything about the transformative power of artificial intelligence (AI) today. But rather than dwell on philosophical debates about AI’s risks and rewards, Big Tech has no time to nurse its wounds.

Just as the dust from DeepSeek settles, Microsoft faces another critical moment: its quarterly earnings report.

A Crucial Test for Microsoft

What better way for Microsoft to address concerns about low-cost AI competitors than to showcase its financial strength?

On Wednesday, after the markets close, the Redmond giant will reveal its latest earnings—a moment that could either calm investor nerves or fuel fresh doubts.

Microsoft’s legacy of success speaks for itself, weathering challenges like the dot-com bubble and emerging stronger every time.

The question now is whether its leadership in AI, cloud computing, and traditional software will continue to drive the astronomical numbers investors expect.

Big Tech’s Leadership Is in the Numbers

Microsoft has built its reputation as a global leader in cloud computing and business productivity software while riding the AI wave.

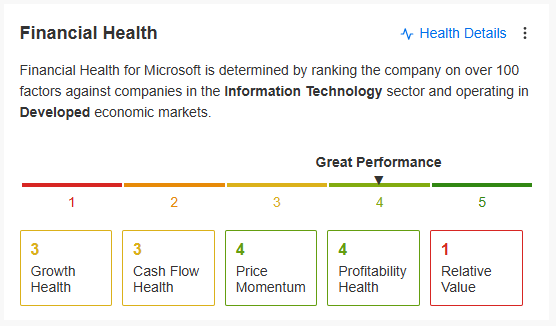

Its financial health is a testament to its dominance, with a staggering 69.35% gross margin, a 36% return on equity, and a revenue increase of 16% in the last quarter.

Source: InvestingPro

Adding to this stability, Microsoft has raised its dividend for 19 consecutive years, currently offering a 0.8% yield. Few companies boast such a track record, and the upcoming earnings report will reveal if it can maintain this momentum.

Analysts Expect Steady Growth

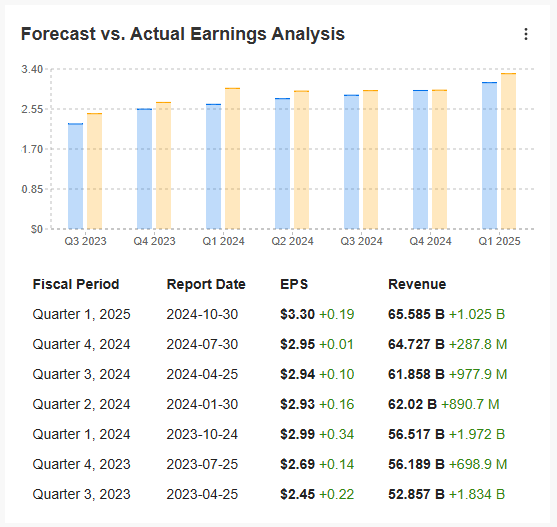

According to analysts, Microsoft is expected to post earnings per share (EPS) of $3.12, up 6.5% from $2.93 a year ago, alongside revenues of $68.8 billion, a 4.9% increase.

Source: InvestingPro

Given Microsoft’s track record of outperforming expectations—beating estimates for seven straight quarters—it wouldn’t be surprising if these figures are exceeded once again.

Source: InvestingPro

What Could Go Wrong?

Despite Microsoft’s strong performance, the stakes are higher than ever. Markets have become unforgiving, as even slight disappointments have sent the stock tumbling in previous quarters.

Source: InvestingPro

Growth is slowing compared to prior periods, partly due to the massive investments in AI development.

Investors are particularly focused on the performance of Microsoft’s cloud segment. Azure’s growth slowed from 33% to 31-32% in the last quarter, sparking concerns.

With capital expenditures rising to fund AI projects, any hint of underwhelming results in these areas could lead to sharp market reactions.

A David vs. Goliath Battle

Adding to the pressure is DeepSeek, a low-cost AI platform from a previously obscure Chinese startup.

DeepSeek has made waves by challenging OpenAI’s ChatGPT – a product heavily subsidized by Microsoft – and raising questions about whether Big Tech’s AI investments are sustainable.

Can Microsoft, the Goliath of tech, fend off this unexpected challenge? The answer won’t come overnight, but Wednesday’s earnings could offer crucial clues about how well the company is positioned to compete in a rapidly evolving landscape.

All Eyes on Wednesday

Microsoft’s ability to beat expectations while navigating AI-related costs and slowing cloud growth will likely define its near-term stock performance. With minimal room for error and mounting competition, the stakes couldn’t be higher.

Stay tuned—this isn’t just about Microsoft’s earnings; it’s about the future of Big Tech in an age of rapid innovation and fierce competition.

***

How are the world’s top investors positioning their portfolios for next year?

Don’t miss out on the New Year’s offer—your final chance to secure InvestingPro at a 50% discount.

Get exclusive access to elite investment strategies, over 100 AI-driven stock recommendations monthly, and the powerful Pro screener that helped identify these high-potential stocks.

Click here to discover more.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.

#Microsoft #Earnings #DeepSeeks #Rise #Adds #Pressure #Deliver #Promises