[ad_1]

You Can Do Better Than the S&P 500. Buy This ETF Instead.

There’s nothing wrong with the S&P 500 (SNPINDEX: ^GSPC) market index.

It reflects the overall health of the American stock market, with a quality filter based on market capitalization. Investing in this market tracker through exchange-traded funds (ETFs) like the SPDR S&P 500 Trust (NYSEMKT: SPY) gives you a ton of diversification and sets you up for robust long-term returns.

If you invested $1,000 in the SPDR fund 10 years ago and set the position up to reinvest dividend payments in more shares, you would have $3,500 today. That’s a compound annual growth rate (CAGR) of 13.2%, leaving inflation rates far behind. Many investors get started in a popular SPDR 500 fund and let it run for decades, building wealth with zero investor effort.

But what if I told you that there are ETFs with even better long-term returns? For instance, the Vanguard Information Technology ETF (NYSEMKT: VGT) tends to beat the S&P 500’s returns in the long haul. It’s one of my favorite ETFs. Let me show you how it works.

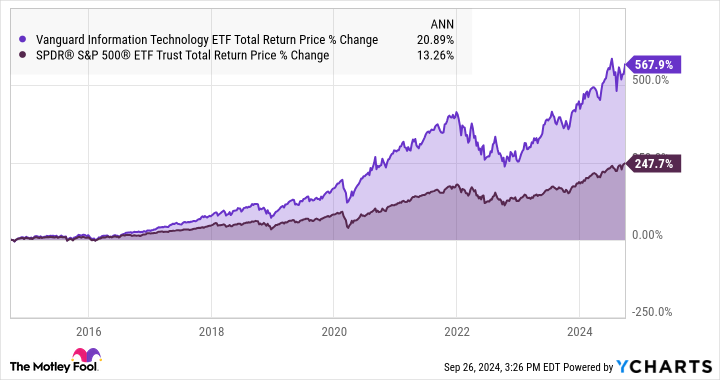

VGT Total Return Price Chart

Why this Vanguard fund is one of my favorite ETFs for long-term growth

As you can see in the chart above, the Vanguard IT ETF has been crushing the S&P 500 and its index trackers over the last decade. The total returns work out to a CAGR of 20.9%. Over this period, a hypothetical $1,000 investment would have grown to $6,678.

And that’s just a simple one-time move with no further cash investments added over time. Let’s imagine an automated dollar-cost averaging plan instead, starting with just $100 in the fall of 2014 and adding another $100 to that Vanguard IT ETF position per month. Some investors can do this as a paycheck deduction, others might set up automatic transfers, and a few may prefer doing it by hand.

Whatever method you use, these fairly painless contributions would add up to $12,000 in a decade. The investment returns would be roughly $29,000, working out to a total investment value of $41,118.

Doing the same thing with the SPDR S&P 500 fund instead would have yielded respectable results, too. The same $12,000 investment should be worth $25,174 by now, more than doubling your money in 10 years.

Like I said, there’s nothing wrong with that. Still, I’d rather have the stronger returns from the IT market tracker.

There’s no reward without additional risks

Of course, I can’t promise market-stomping returns over every conceivable time period. The fund underperformed the S&P 500 in its first five years on the market, ending amid the subprime market meltdown of 2008-2009. The inflation crisis of 2022 was no fun for Vanguard IT ETF investors, either.

Story continues

In challenging markets like these hand-picked examples, the ETF’s focus on high-growth investment ideas can result in deeply negative returns. I had to search for these unfavorable examples, and this ETF tends to beat the S&P 500 over long time periods.

Still, this might not be the fund for you if you can’t afford the occasional price drop along the way. The fund outperforms in most cases, but it can really hurt when growth stocks run into a brick wall.

How this ETF’s portfolio differs from the S&P 500

The fund follows a market index reflecting all American stocks in the information technology sector, resulting in a list of 317 names at the latest update.

They are weighted by market cap. Therefore, tech titans Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), and Nvidia (NASDAQ: NVDA) are the three largest holdings these days. These three stocks add up to roughly 48% of the total portfolio.

The same three companies also dominate the S&P 500, but their combined weight stops at just 20% right now. The IT index includes many stocks that are too small for the S&P 500.

So the IT-focused fund places a heavier load on the largest companies, but also lets smaller businesses contribute to the total score. It’s a different balancing act that raises market risks but also the potential returns.

Is the Vanguard Information Technology ETF right for you?

You’ve seen the long-term returns, and I showed you the potential downsides. I don’t mind if you prefer something like the SPDR S&P 500 ETF in the end. It will probably let you sleep better at night, at least in challenging periods like the market crises I highlighted earlier.

I’m just happy to have shown you a more exciting option. The Vanguard Information Technology ETF isn’t every investor’s cup of tea, and that’s OK. I highly recommend taking a sip, though. These thrilling high-growth ideas can be intoxicating over the long haul.

Should you invest $1,000 in Vanguard World Fund – Vanguard Information Technology ETF right now?

Before you buy stock in Vanguard World Fund – Vanguard Information Technology ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard World Fund – Vanguard Information Technology ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Anders Bylund has positions in Nvidia and Vanguard World Fund-Vanguard Information Technology ETF. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

You Can Do Better Than the S&P 500. Buy This ETF Instead. was originally published by The Motley Fool

[ad_2]

Source link

#Buy #ETF